The IRS has announced the official 401k contribution limits for 2025, setting clear caps on how much employees and employers can contribute to workplace retirement plans. These limits apply to both traditional and Roth 401(k) accounts and are adjusted annually to reflect inflation and cost-of-living changes.

401k Contribution Limits 2025

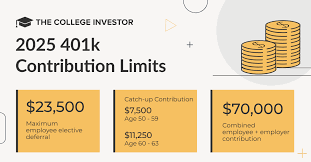

For tax year 2025, the maximum employee salary deferral is $23,500. The combined limit for employee and employer contributions is $70,000.

- Employee salary deferral limit (under age 50): $23,500

- Combined employee + employer contributions: $70,000

- Catch-up contributions (age 50–59 or 64+): $7,500

- Catch-up contributions (age 60–63, if plan allows): $11,250

This means individuals age 50 to 59 or 64 and older may contribute up to $31,000 in 2025. Those aged 60 to 63 may contribute up to $34,750 if their plan permits the higher catch-up amount.

401k Contribution Limits 2024

- Employee salary deferral limit: $23,000

- Combined employee + employer contributions: $69,000

- Catch-up contribution (50+): $7,500

- Maximum with catch-up: $30,500

401k Contribution Limits 2023

- Employee salary deferral limit: $22,500

- Combined employee + employer contributions: $66,000

- Catch-up contribution (50+): $7,500

- Maximum with catch-up: $30,000

Roth 401k Contribution Limits

The Roth 401k contribution limits for 2025 are the same as traditional 401(k) plans. If you contribute to both a Roth and a traditional 401(k), your total contributions cannot exceed the $23,500 employee limit for 2025.

Contribution Limits with Multiple 401k Plans

If you participate in more than one 401(k) plan, the total employee deferral across all plans cannot exceed $23,500 in 2025. Employer contributions are counted separately but are still subject to the combined $70,000 annual cap.

After-Tax 401k Contributions

Some plans allow additional after-tax contributions once pretax and Roth limits are reached. For 2025, the total contribution (pretax, Roth, after-tax, and employer match) cannot exceed $70,000 or 100% of your eligible compensation, whichever is lower.

Example: If you contribute $23,500 and your employer contributes $20,000, you may add up to $26,500 in after-tax contributions, provided your plan permits it.

What Happens if You Contribute Too Much?

Exceeding the annual 401(k) contribution limits may result in double taxation. Excess deferrals must be withdrawn by April 15 of the following year. These distributions, along with earnings, are reported on Form 1099-R.

How Much Should You Contribute to a 401k?

Financial experts recommend saving at least 15% of your annual income (including employer match) toward retirement. If you cannot contribute that much right away, start with a lower percentage and increase your contributions each year or when you receive raises.

How to Maximize Your 401k Contributions

- Start early: The sooner you begin contributing, the more compound growth works in your favor.

- Get the full employer match: Contribute at least enough to capture your company’s matching contributions.

- Increase contributions gradually: Raise your contribution rate by 1% annually or when your salary increases.

- Review old accounts: Consolidate or track past 401(k)s to ensure your savings strategy is aligned.

- Consider IRAs for additional savings: If you max out your 401(k), you can still contribute to a Roth IRA or traditional IRA.

The updated 401k contribution limits for 2025 provide workers with more opportunities to save for retirement. By maximizing contributions, leveraging employer matches, and avoiding excess deferrals, you can strengthen your retirement plan and build long-term financial security. Always confirm contribution rules with your plan administrator to ensure compliance.

- https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

- https://www.fidelity.com/learning-center/smart-money/401k-contribution-limits