Losing a loved one can create financial uncertainty, which is why many families turn to the Social Security Survivor Benefits Calculator to estimate potential payments.

This tool helps widows, widowers, and dependent children understand what they may receive if a family member who worked and paid Social Security taxes passes away.

Knowing how the calculator works allows survivors to plan ahead and make informed financial decisions.

What is the Social Security Survivor Benefits Calculator?

The Social Security Survivor Benefits Calculator is an online tool provided by the Social Security Administration.

It helps estimate how much a surviving spouse, child, or dependent parent might receive after the death of a worker.

The calculator uses details about the worker’s age, earnings history, and relationship to the survivor to project benefit amounts.

While it cannot give an exact figure, it provides a close estimate based on official Social Security formulas.

Who can use the Social Security Survivor Benefits Calculator?

People often ask who can use the Social Security Survivor Benefits Calculator.

It is designed for potential beneficiaries such as widows, widowers, unmarried children under 18, disabled children, or dependent parents of the deceased worker.

Each situation is unique, so the calculator guides users by asking about family relationships and the deceased worker’s background.

This helps determine which survivor benefits may apply.

How does the Social Security Survivor Benefits Calculator work?

The next question is how the Social Security Survivor Benefits Calculator works.

The tool requires basic details about the deceased worker, including their date of birth, estimated annual income, and age at death.

It also asks about the survivor’s relationship and age.

Using these inputs, the calculator applies the Social Security formula to estimate monthly payments.

The final amount depends on the worker’s average lifetime earnings and the survivor’s eligibility factors.

What information do you need for the Social Security Survivor Benefits Calculator?

To use the Social Security Survivor Benefits Calculator, you need specific information.

This includes the deceased worker’s earnings history, age at death, and whether they had already started claiming Social Security.

Survivors should also provide their own date of birth, current income status, and relationship to the deceased.

Having accurate information ensures the calculator gives a more reliable estimate.

Can the Social Security Survivor Benefits Calculator estimate benefits for children?

Many families ask if the Social Security Survivor Benefits Calculator can estimate benefits for children. The answer is yes.

Eligible unmarried children under 18, or up to 19 if still in high school, may receive benefits.

Disabled children may qualify at any age if the disability began before age 22.

The calculator includes questions about dependents, allowing parents to see what support their children might receive after a worker’s death.

How accurate is the Social Security Survivor Benefits Calculator?

Another common question is how accurate the Social Security Survivor Benefits Calculator really is. The tool provides estimates, not final determinations.

Actual benefit amounts may differ depending on changes in earnings records, updates in Social Security law, or adjustments made by the Social Security Administration.

For a more precise figure, survivors should request an official benefits estimate directly from the SSA.

Where can you access the Social Security Survivor Benefits Calculator?

Finally, people ask where to access the Social Security Survivor Benefits Calculator.

It is available on the official Social Security Administration website under the calculators section.

Users can try different scenarios, such as varying retirement ages or income levels, to see how survivor benefits may change.

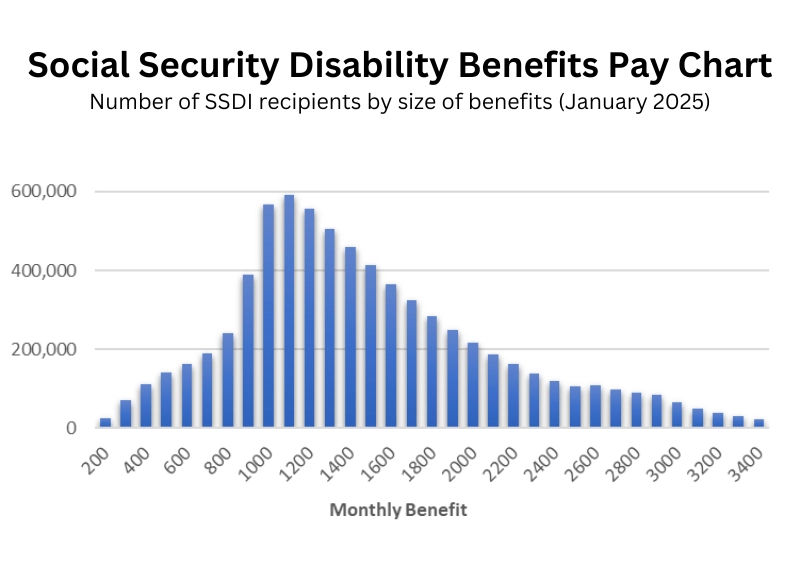

The site also links to other tools, including the retirement and disability calculators, to help families get a full picture of potential benefits.