Social Security Disability Insurance (SSDI) provides essential financial support for millions of Americans who cannot work due to a qualifying disability.

Each year, the Social Security Administration (SSA) adjusts benefits through a cost-of-living adjustment (COLA) to help recipients keep pace with inflation.

For 2025, SSDI beneficiaries will receive a 2.5 percent COLA increase, affecting both monthly benefits and Supplemental Security Income (SSI) payments.

What is the 2025 COLA for Social Security disability?

The SSA announced that the 2025 cost-of-living adjustment for Social Security benefits, including disability payments, will be 2.5 percent.

This percentage is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of 2024 compared with the same period in 2023.

The COLA applies to all Social Security beneficiaries, including retired workers, survivors, and individuals receiving disability benefits.

How will the COLA affect SSDI monthly benefits?

For SSDI recipients, the 2.5 percent increase will slightly raise monthly payments.

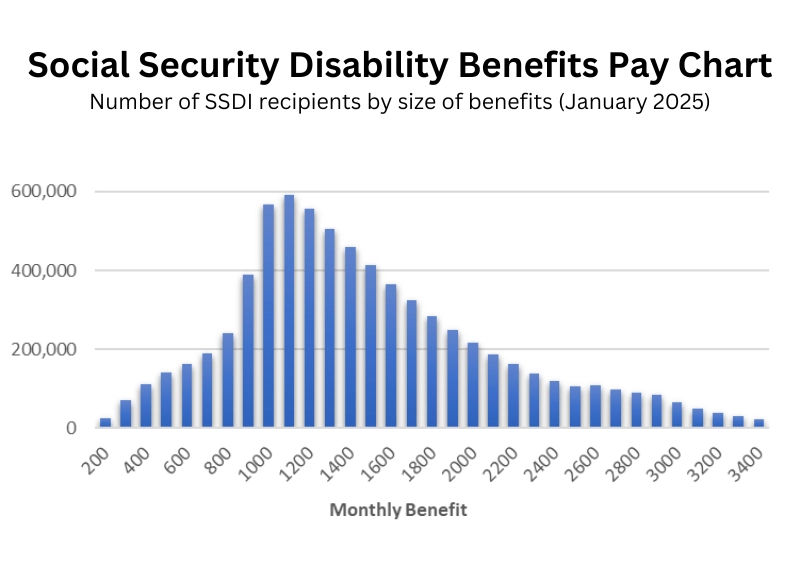

The average SSDI benefit in August 2025 was approximately $1,583.

A 2.5 percent COLA increases this by about $40, bringing the new average monthly benefit to $1,623

Individual benefits may vary depending on a person’s earnings history and when they became disabled.

This increase helps recipients maintain their purchasing power despite rising prices for housing, food, and medical care.

What changes will occur for Supplemental Security Income (SSI)?

SSI provides financial support for individuals with limited income and resources who are disabled or aged 65 and older.

The 2025 COLA also applies to SSI, raising the maximum federal payment for an eligible individual to $967 per month, up from $943 in 2024.

For an eligible couple, the maximum payment increases to $1,450 per month.

The new rates take effect on January 1, 2025, although December 31, 2024, is used for calculation purposes.

When will beneficiaries receive the COLA increase?

The COLA increase is effective January 2025, meaning beneficiaries will see the higher payment in their first January 2025 deposit.

Those who receive SSDI or SSI through direct deposit should notice the adjustment automatically in their bank accounts.

No separate application is needed to receive the increase.

Will the COLA affect Medicare premiums?

Although the COLA increases SSDI and SSI benefits, it does not directly increase Medicare premiums.

However, some SSDI beneficiaries who are under 65 may already be enrolled in Medicare or become eligible after a 24-month waiting period.

Medicare Part B premiums are usually adjusted each year, and the COLA may offset increases in premiums to some degree.

Recipients should review any new premium amounts from the Centers for Medicare and Medicaid Services (CMS) to understand the net impact on their benefits.

How does the COLA relate to the Social Security taxable earnings cap?

The COLA increase for 2025 comes alongside an increase in the maximum taxable earnings for Social Security purposes.

For 2025, the wage base is $176,100, up from $168,600 in 2024.

Earnings above this limit are not subject to the Social Security payroll tax, but all eligible wages up to this cap contribute to an individual’s SSDI benefits calculation.

This ensures the system remains funded while maintaining fairness for high earners.

What should SSDI beneficiaries do to prepare for the 2025 COLA?

Beneficiaries should verify that their direct deposit information is current to ensure the COLA adjustment is received without delay.

Checking their my Social Security account online is recommended to confirm payment schedules and amounts.

Additionally, understanding how the COLA interacts with other income or benefits, such as Supplemental Security Income, Medicaid, or state disability programs, helps beneficiaries plan their monthly budgets effectively.

Finally, beneficiaries should keep copies of their SSA notices and monitor official announcements from SSA for any updates.

The 2025 Social Security COLA provides a modest but important boost to help SSDI and SSI recipients maintain their financial stability amid inflation.

By understanding the changes, verifying eligibility, and updating account information, beneficiaries can maximize the benefits of this annual adjustment.