The cost-of-living adjustment (COLA) is a vital piece of the Social Security system in the United States.

Each year, the Social Security Administration (SSA) determines whether benefits should rise to match inflation.

The 2026 Social Security COLA is especially important because many retirees and beneficiaries depend on it to preserve their purchasing power.

While the official percentage will not be released until October 2025, analysts and experts have strong forecasts.

What is the Social Security COLA?

COLA stands for “cost-of-living adjustment.” It is an annual increase in Social Security and Supplemental Security Income (SSI) benefits intended to counteract inflation.

The SSA bases the COLA on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

If prices rise, benefits go up; if prices do not rise, there may be no increase.

The COLA ensures that benefits maintain their real value over time.

How is the 2026 Social Security COLA calculated?

The SSA compares the average CPI-W for the third quarter (July, August, September) of the current year against the same period one year earlier.

If the CPI-W has increased, that percentage rise becomes the COLA.

The SSA then applies that percentage increase to benefit amounts effective the next January. Past COLA calculations follow this method.

The final inflation data for that third quarter is published by the Bureau of Labor Statistics (BLS), and the official COLA announcement usually occurs in October.

When will the 2026 COLA be announced and take effect?

The official 2026 Social Security COLA will be announced around mid-October 2025, using the July–September 2025 CPI-W data.

Once announced, the increase is applied starting with the first Social Security benefit paid in January 2026.

That is the standard timeline the SSA has followed for years.

What size increase is being forecast for 2026?

Forecasts for the 2026 Social Security COLA center on a 2.7 percent increase.

AARP notes that August 2025’s CPI-W rose 2.8 percent year over year, which supports estimates in that range.

The Senior Citizens League has also projected that a 2.7 percent adjustment is likely.

If that holds, the average retired worker benefit could increase by roughly $54 per month.

Some analysts caution that if inflation slips, the COLA might be lower — but most see 2.7 percent as a reasonable estimate.

Who benefits from the Social Security COLA increase?

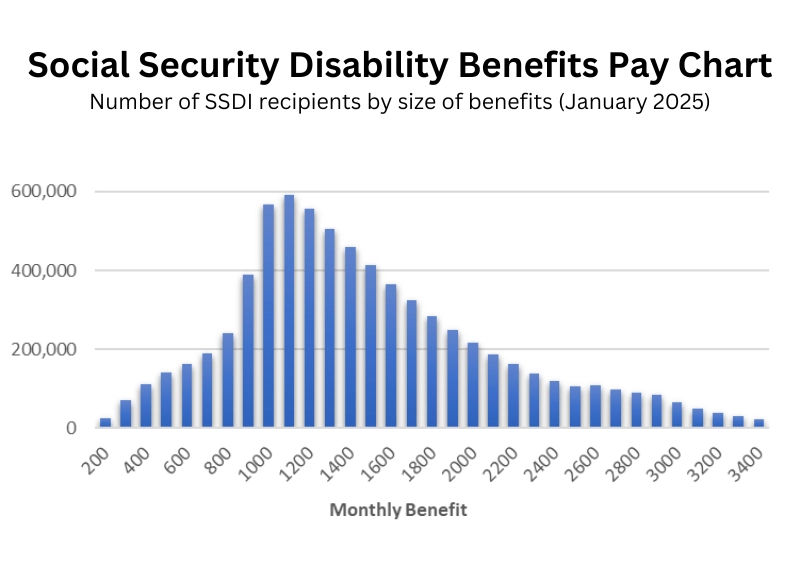

All beneficiaries whose payments come from Social Security will see the COLA increase, including retirees, disabled workers (SSDI), survivors, and SSI recipients.

Because SSI is tied to Social Security adjustments, those payments tend to increase as well.

The COLA applies automatically — beneficiaries do not need to apply or fill out extra paperwork.

Will any deductions reduce the effective increase?

Yes. Medicare Part B premiums, Medicare Part D or other health insurance costs, and any other payroll tax obligations can reduce how much of the COLA increase beneficiaries actually “see.”

In past years, significant premium increases have eaten into the net benefit boost.

Also, some beneficiaries face “clawbacks” when they exceed income thresholds for taxation of benefits, which can lessen effective gains.

Will there be changes to how COLA is computed beyond 2026?

Yes. The SSA has proposed provisions affecting future COLAs.

Starting in December 2026, the SSA plans to reduce the annual COLA by 1 percentage point (though not below zero).

There is also a discussion of computing COLA using a chained version of the CPI-W, which would tend to yield slower increases.

These proposals aim to reduce long-term cost pressures on the Social Security system, but any changes must survive legal, regulatory, or congressional processes.