Each year, Social Security benefits are adjusted with a cost-of-living adjustment (COLA).

That increase for 2026 isn’t official yet, but analysts have strong predictions.

Also, the 2026 payment schedule has already been published by SSA.

What is the latest projected COLA increase for 2026?

While SSA hasn’t announced the official 2026 COLA yet, many forecasts put it around 2.7 %.

- The Senior Citizens League (TSCL) now projects a 2.7 % increase. (0search7)

- If that holds, for the average retired worker (benefit in August 2025 of ~$2,008) it would boost benefits by about $54 per month.

- Some earlier forecasts were more conservative (2.4 % or 2.5 %), but inflation trends and recent CPI data support the higher estimate.

So while nothing is set, 2.7 % is a widely cited estimate.

How is the COLA determined and when is the official number announced?

The SSA compares the average CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) for July, August, and September to that same period in the prior year.

If prices rise, the increase becomes the COLA.

The official announcement usually comes in October, after the BLS (Bureau of Labor Statistics) publishes September inflation data.

The benefit increase then takes effect in January 2026. Many forecasts still rely on preliminary CPI data and economic trends. (0search16)

Recent government shutdowns had threatened delays in data release, but announcements are back on track.

What would that raise look like in dollar terms?

Using a 2.7 % estimate:

- For someone receiving $2,008/month (average retired-worker benefit in August 2025), a 2.7 % increase is about +$54 per month.

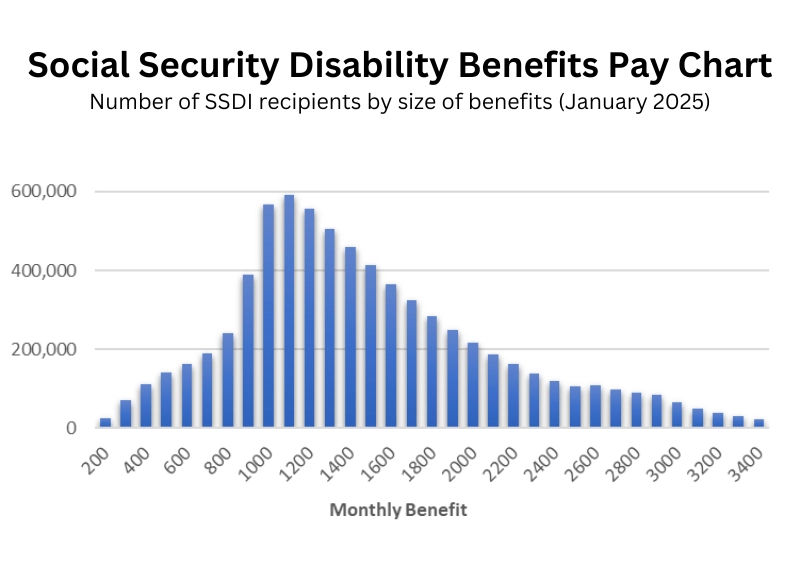

- For survivors or disability beneficiaries, similar proportional increases apply based on their current benefit levels.

These are estimates — your actual increase will depend on your current benefit and the final COLA.

What changes in 2026 beyond COLA?

Among the expected changes:

- Wage base increase: The limit on earnings subject to Social Security tax is projected to rise. For 2026, the taxable wage base may reach $183,600.

- Other thresholds tied to inflation (such as earnings test limits) may adjust upward along with the COLA.

- SSA has a provision (in its solvency proposals) that starting December 2026, COLAs could be reduced by certain amounts or based on chain index formulas.

So while COLA raises benefits, the landscape for 2026 includes other inflation-based adjustments.

What is the 2026 payment schedule for Social Security?

The SSA has already published the Schedule of Social Security Benefit Payments – Calendar 2026.

Some key points:

- Benefits for those receiving Social Security before May 1997 or receiving both Social Security & SSI are paid on the 3rd of each month.

- For most beneficiaries, payments are issued on the second, third, or fourth Wednesday of each month, depending on birthday.

- SSI (Supplemental Security Income) is typically paid on the 1st of each month, unless it falls on a weekend, in which case the payment is made on the preceding business day.

- Adjustments are made if the regular payment date falls on a holiday.

For example, in January 2026, Social Security benefit payments are scheduled on dates according to the published schedule in SSA’s 2026 calendar.

What should you do to prepare for the 2026 changes?

- Use current forecasts (e.g. 2.7 %) as a planning baseline, but don’t commit until SSA official numbers are published.

- In December 2025, check your my Social Security account for the COLA notice and updated benefit.

- Review your deductions — Medicare premiums or taxes may reduce how much of the increase you actually net.

- Monitor announcements in October 2025 for the official COLA release and any related SSA changes.

- Use the 2026 payment schedule from SSA to plan when to expect your checks.